- Cuba says inflationary pressures and geopolitical uncertainty could make Bitcoin a global reserve currency

- The Billionaire Thinks Trump’s Lower Taxes and Tariffs Could Drive Bitcoin Prices Higher

- Elon Musk plans to spend $45 a month to support Trump’s presidential campaign

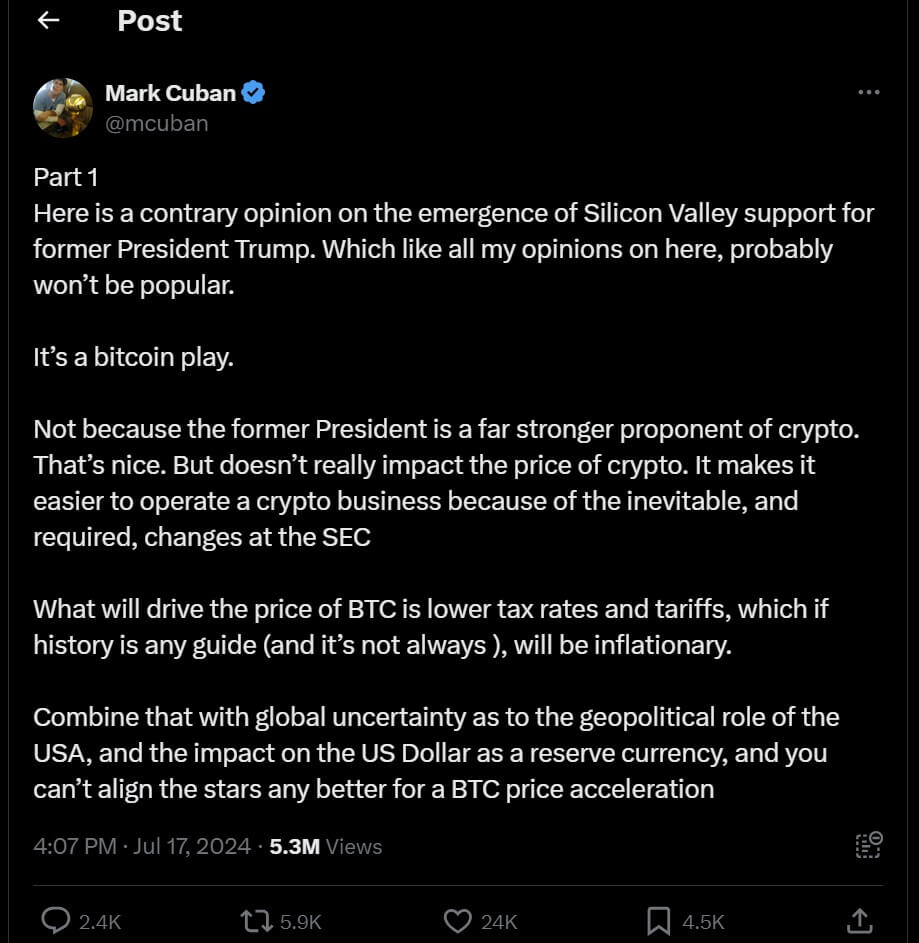

American billionaire Mark Cuban believes that Bitcoin could become a global reserve currency due to a combination of inflationary pressures and geopolitical uncertainty.

The billionaire said in an interview with The Cuban, who supports Joe Biden’s re-election, said lower taxes and tariffs under Trump could push the price of Bitcoin higher.

“Add to this global uncertainty about the U.S.’s geopolitical role, and the impact of the U.S. dollar as a reserve currency, and you couldn’t be better positioned for Bitcoin price acceleration,” Cuban wrote.

He added that this would make it “easier for crypto businesses to operate as the SEC inevitably makes necessary changes.”

How Bitcoin Could Become a Global Reserve Currency

Questioning how high Bitcoin could go, Cuban didn’t give a specific number but wrote it was “much higher than you think,” adding that this was due to its global status, a cap of 21 million Bitcoins, and the fact that the currency has infinite fragmentation.

Cuban believes that if geopolitical uncertainty persists and the U.S. dollar’s status as a reserve currency declines, Bitcoin may become a safe haven as countries seek to protect their savings and thus turn to Bitcoin.

While he only said it was a possibility, he stopped short of saying it would happen, but added that it was already happening in countries facing hyperinflation.

After Trump was injured in an assassination attempt at a campaign rally in Pennsylvania, Musk formally endorsed the former Republican president, saying he plans to donate $45 a month to a new super PAC to support Trump’s presidential campaign.

In March, billionaire Elon Musk said he would not vote for a Democrat in November. The tech tycoon, who also owns Tesla and SpaceX in addition to

In recent discussions surrounding the potential of Bitcoin as a global reserve currency, American billionaire Mark Cuban has expressed his views on the matter. Here, we delve into the key points raised by Cuban and explore the implications of Bitcoin’s role in the financial landscape.

### The Case for Bitcoin as a Global Reserve Currency

Cuban believes that Bitcoin could emerge as a global reserve currency, citing inflationary pressures and geopolitical uncertainty as driving factors. He suggests that the combination of these elements could position Bitcoin as a viable alternative to traditional fiat currencies.

### Factors Influencing Bitcoin’s Price

One of the key factors influencing Bitcoin’s price, according to Cuban, is the impact of political decisions such as tax cuts and tariffs. Cuban notes that policies implemented by leaders like Trump can have a significant effect on the value of Bitcoin, potentially driving prices higher.

### The Future of Bitcoin in a Changing Financial Environment

Looking ahead, Cuban speculates on the potential growth of Bitcoin, emphasizing that its value could exceed current expectations. He points to Bitcoin’s global status, limited supply, and divisibility as factors that could contribute to its upward trajectory.

### Conclusion

As discussions on Bitcoin’s role in the financial world continue to evolve, Cuban’s insights shed light on the potential for Bitcoin to play a more prominent role as a global reserve currency. With ongoing geopolitical uncertainties and shifting economic landscapes, the future of Bitcoin remains a topic of interest and speculation among investors and analysts alike.