Cryptocurrency Market Activity and Whale Interest

The cryptocurrency market has experienced a slight decline in activity over the past week, resulting in a 4% drop in global market capitalization in the last 24 hours. Despite this overall trend, certain assets have caught the attention of crypto whales – large investors who are anticipating a market rally in the near future and are positioning themselves accordingly.

Toncoin (TON) Sees Uptick in Crypto Whales Count

Toncoin (TON), the native cryptocurrency of popular messaging app Telegram, has recently experienced a 17% decline in value over the past month. However, analysis of on-chain data has indicated that this dip may present a buying opportunity for savvy investors.

One key indicator, the Market Cap to Realized Value (MVRV) ratio, suggests that TON is currently undervalued and could be primed for a resurgence. The negative MVRV ratios, particularly in relation to the 30-day and 90-day moving averages, point to a potential buying signal for traders.

Furthermore, data from Santiment reveals a notable increase in the number of TON whales holding significant amounts of the cryptocurrency. This surge in whale interest may signal broader investor confidence in the potential future growth of TON.

Large Holders Increase Their Tron (TRX) Holdings

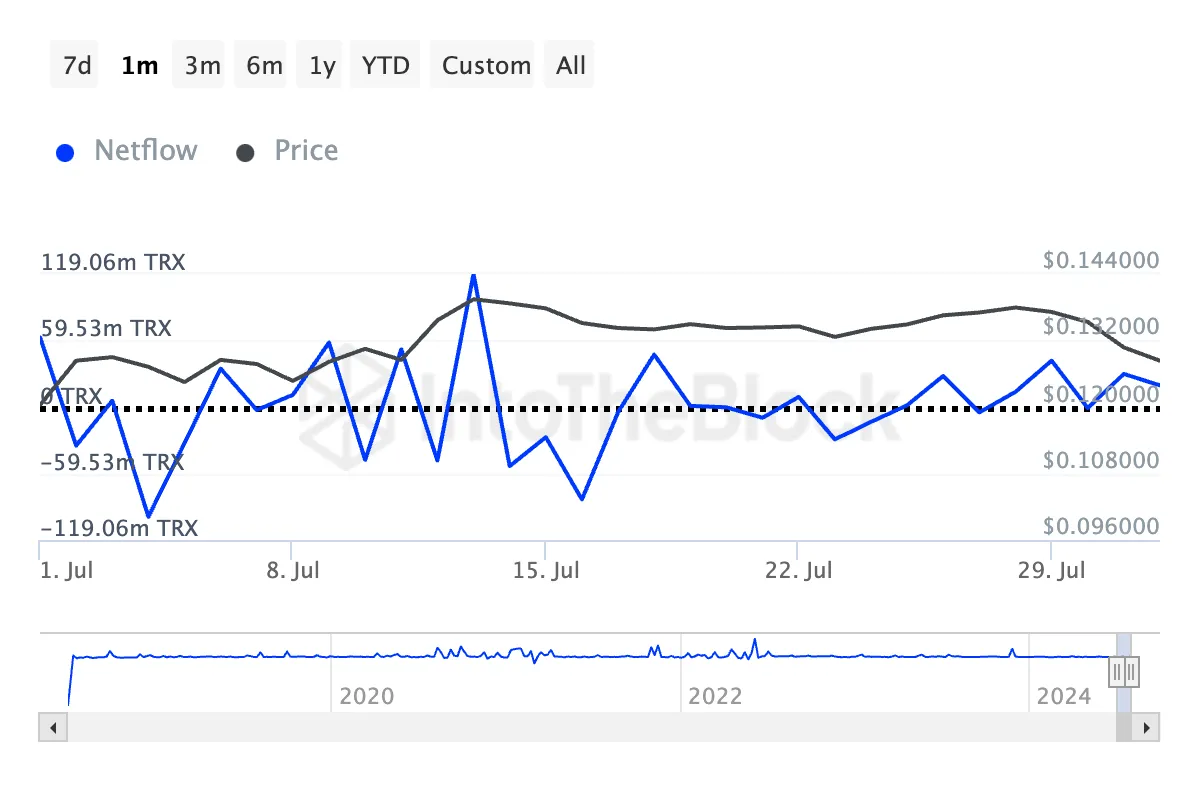

Recent on-chain data from IntotheBlock indicates a 243% increase in net inflows from large Tron (TRX) holders over the past 30 days. This uptick in activity suggests that major players in the TRX market are actively accumulating more tokens.

Despite TRX’s sideways trading pattern in recent weeks, the continued accumulation by TRX whales could pave the way for increased demand and a potential price surge. Observing the daily chart, it is evident that TRX has been consolidating within a defined range, indicating a possible breakout in the near future.

Binance Coin (BNB) and Emerging Bullish Divergence

While Binance Coin (BNB) has struggled to establish a clear price trend in recent weeks, the Kaikin Fund Flow (CMF) indicator suggests a positive outlook. The rising CMF values indicate a growing influx of capital into the BNB market, potentially signaling bullish intentions among large investors.

If BNB can break out of its current trading range, there is a possibility of the price reaching $617, driven by the increased buying pressure highlighted by the CMF indicator.

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from the use of the information on this website. In addition, part of the content is the AI translation version of the English version of the BeInCrypto article.